Many families in Australia who are renovating or rebuilding their homes often need to take out a loan to support the high cost of construction. In a recent construction contract we reviewed, we noticed that a key document – Home Building Compensation Insurance (HBC Insurance) – was missing from the agreement between the homeowner and the contractor. This omission, which appears to be a lack of documentation, could directly hinder loan disbursement and even delay the start of construction.

In residential construction projects involving knock-down rebuilds, major refurbishments, etc., New South Wales law requires contractors to take out HBC Insurance by law and issue appropriate certificates to homeowners whenever the amount of work exceeds a certain threshold. This obligation is not only a legal requirement, but also one of the core materials used by banks when reviewing construction loans. If the contractor fails to provide the required insurance documents, the lending institution will often refuse to release the loan directly, which in turn will affect the funding arrangement and progress of the whole project.

We have previously covered this in “Avoiding Unfinished Renovations! NSW Builders Insurance Obligations” article, which covered the basic system and implications of HBC insurance. In this article, we will further focus on the legal effect and practical implications of this insurance material in the context of construction loans. We’ll sort out the key differences in the review process for construction loans versus regular home loans, explain exactly where HBC insurance affects the loan application, and offer practical advice based on our experience to help homeowners prepare at an early stage to ensure that the financial arrangements and legal obligations are in place at the same time.

Reference article: Avoiding Unfinished Renovations! NSW Builders Insurance Obligations

A construction loan is a type of home loan that is designed for borrowers who wish to renovate or rebuild their homes. Compared to a typical home loan, a construction loan is more specialized in the form of a progressive drawdown structure, whereby the bank disburses the funds in stages according to the progress of the construction. Since the loan funds are not disbursed in one go, but are gradually disbursed along with the progress of the construction, the bank needs to assess the construction situation at each stage. This means that construction loans often require on-site evaluation to ensure the proper use of funds. General housing loans, on the other hand, are mostly based on transactions of existing homes and do not involve actual construction, so on-site evaluation is usually not required and can be accomplished through an online process.

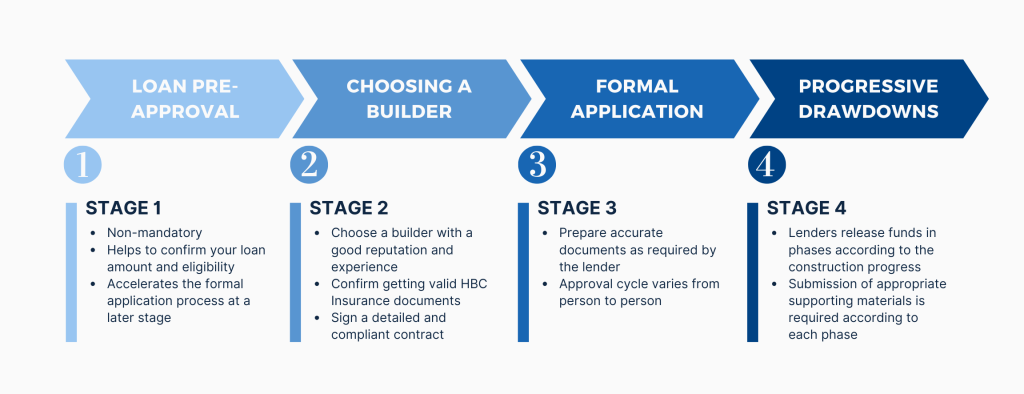

a) The general process of a construction loan is as follows:

First, borrowers have the option of applying for a loan pre-approval (pre-approval). Although this step is not mandatory, it helps to know their loan amount and basic eligibility in advance, and also adds confidence to the subsequent selection of the builder and signing of the contract.

Next, the borrower will choose a builder based on his or her budget and renovation needs, and sign a formal construction contract. Although the bank is not yet officially involved in the review process, the borrower should still ensure that the contract, construction drawings, quotation list, and HBC Insurance are complete and standardized, so that the subsequent loan application process can proceed smoothly.

The borrower then formally submits the loan application to the bank. The bank will comprehensively assess the borrower’s repayment ability, the feasibility of the construction project, and the compliance of the contract terms and conditions, etc. The overall approval process is more complex and stringent than that of an ordinary home loan.

Upon approval of the loan, the bank will disburse the construction costs in stages according to the progress agreed in the contract. Each disbursement will be subject to the provision of documentary proof of the corresponding stage to ensure that the construction has indeed progressed to the corresponding stage. This is why a site inspection and assessment is essential.

This image is an original creation by the author based on relevant data and materials. The copyright belongs to Sunfield Chambers Solicitors & Associates. Unauthorized reproduction, modification, or commercial use in any form is prohibited. For reprinting, please cite the source and contact marketing@schambers.com.au for permission.

b) What is the real reason the loan gets declined?

We consulted an experienced loan broker (broker), who pointed out that there are many factors that can cause a loan not to be approved: for example, whether the borrower’s income is stable and sustainable; whether the personal credit score is up to standard; and whether the chosen builder is qualified. Among them, he emphasized one point in particular – HBC Insurance is a mandatory requirement for bank approval and cannot be omitted, which is often overlooked by borrowers who fail to prepare for it at the initial stage.

What’s more, it is important to note that once the loan is not approved, the deposit paid to the homeowner is usually not recoverable, which is a considerable risk for the borrower. Therefore, each step should be prepared with extra care before entering the loan process to avoid financial losses due to negligence of details.

As mentioned earlier, for construction loans involving reconstruction or major renovations, HBC Insurance is one of the mandatory documents in the loan approval process. Although the point at which the bank formally reviews the HBC Insurance usually occurs at the loan application stage, the impact of this insurance on the entire process actually begins long before the bank gets involved. The reason for this is that a construction loan is contingent on a signed construction contract, and HBC Insurance from the builder is mandatory at the time of signing the contract.

Banks such as NAB, for example, clearly state in their lending guidelines that borrowers should check whether the builder can provide a legal and valid HBC Insurance at the selection stage, because according to NSW law, HBC Insurance is a mandatory pre-condition for carrying out construction work, and commencing construction work without this insurance would be in breach of the law.

So, while HBC Insurance is one of the loan documents on paper, it actually has a much more far-reaching impact, determining whether or not the entire construction project can get off the ground.

1) Get pre-approved for a loan before it’s too late:

Even if you haven’t made a final decision on which lot to build on, it’s advisable to apply for a loan pre-approval as soon as possible. This step is simply a preliminary assessment of your financial situation. Though not a mandatory part, the benefits of pre-approval are very tangible; so you know exactly how much you can borrow at most and have better control over your overall expenses.

However, it is important to note that pre-approval is time-limited and does not equate to formal loan approval. Therefore, once the project is finalized, it should enter the formal approval process as soon as possible to avoid missing the pre-approval validity period due to time delays.

2) The builder must provide HBC Insurance:

One of the most important requirements for a construction loan is that the builder you choose must be able to produce legal and valid HBC Insurance, which is a mandatory part of the bank’s review and is required by NSW statute.

Banks usually check for insurance coverage at the loan approval stage, but in reality, without the ability to issue HBC Insurance, the entire construction project will not move forward. Therefore, it is important to confirm the purchase of HBC Insurance with the builder at the beginning of the process of selecting a builder. If this step is overlooked, the entire loan process may get stuck.

Reference article: Avoiding Unfinished Renovations! NSW Builders Insurance Obligations

3) Seek professional advice in a timely manner:

Many borrowers think that taking out a loan is just a matter of “submitting information + waiting for approval”, but in reality it involves a lot of policy details, compliance documents, and the bank’s internal evaluation logic.

The professional intervention of a loan broker and a lawyer can often help you avoid risks in advance. For example: broker will match the most appropriate loan structure and banks to your situation, and give you a early warning of potential risks (such as flood zone); lawyers will assist you in the preparation of materials and move the process along at a pace that ensures you are compliant and in control at every stage.

A major renovation is a long-term project that not only has a high capital investment and many stages, but also involves a great deal of detail and delineation of responsibilities. The sooner you find the right loan broker and attorney to get involved, the better it will be to help you avoid risk and ensure the process moves forward smoothly.

–

Sunfield Chambers Solicitors & Associates is a full-service law firm located in the heart of Sydney with extensive experience in the practice of real estate law. Our professional team is familiar with the review of construction contracts, preparation of loan documents and related legal compliance processes, and is able to provide timely and sound legal support to our clients during the process of building a home or applying for a loan. Whether it is risk prediction before signing a contract or document gatekeeping during the loan process, we can provide you with clear advice and grounded solutions.

Written by Xueying Yang; Content planning: Zhou Yan; Xueying Yang; Proofreading: Sun Gang

The content of this article is based on publicly available information and the author’s understanding, and does not constitute any form of professional legal advice or basis for business decisions. Readers should refer to this article in the context of their own actual situation and consult relevant professionals for specific guidance. The author and the publishing platform do not assume legal responsibility for any consequences arising from the use of the information in this article.

Consultation with Specialized Lawyers

Amy Zhu

Partner, Senior Licensed Conveyancer

Amy is an experienced licensed conveyancer with years of experience in conveyancing matters. She has outstanding work experience and achievements in conveyancing services under property law and conveyancing law provisions. She is skilled in working with clients in Mandarin and English.

Eloise Qi

Solicitor

Eloise was equipped with solidly theoretical foundation and exposed to various practical experience to strengthen her professional capabilities in property, business and corporate matters. She currently focuses on Australian property law and handling conveyancing matters.

Jingjing Zhan

Solicitor

Jingjing brings a strong background in property law, focusing on the acquisition and sale of residential and commercial properties, commercial and retail leasing, and business transactions. Additionally, she provides strategic advice on loan agreements and family law matters, including divorce applications and financial agreements.

Yan Zhou

Solicitor

Yan worked as a paralegal in late 2018 and attended the University of Sydney to study law. She received her Juris Doctor degree in 2024, and spent the second half of the year practicing law full-time in a law-related capacity, currently focusing on conveyancing.

Latest Posts:

- Privacy Challenges in the AI Era: Is Your Information Truly Secure?

- 5% Deposit Scheme Explained: New Opportunities for First Home Buyers

- Zong Fuli Steps Down: The Succession Challenge for Private Enterprises

- “I want a divorce, but he’s in prison overseas” – Wang Nuannuan’s cross-border divorce dilemma

- What is International Public Notary? A Practical Guide for Seamless Cross-Border Document Circulation

- Experiencing Domestic Violence or Harassment? Criminal Lawyers Show You How to Effectively Use AVO to Respond